Table of Contents

Introduction

What does the Finance Team do?

Strategic Finance in Action

Building a Strategic Finance Team

Strategic Finance Best Practices

Conclusion

Introduction

If you were to ask anyone at a tech startup to conjure up an image of the “Finance team”, it’s quite likely that many individuals would immediately imagine characters like Kevin, Oscar and Angela from “The Office.” This association with the beancounter stereotype isn't that surprising, as finance professionals have historically been seen as ancillary players at startups.

But the scope and role of the modern Finance team are changing. Finance is becoming increasingly strategic and now influences major company decisions across product, go-to-market, infrastructure, and operations.

A high-performing Finance team has gone from being a “nice-to-have” to a “need-to-have” and is now a major competitive advantage for startups.

The rise of the modern Finance team has coincided with the growing popularity of the “Strategic Finance” function within technology startups. StratFin, as it’s sometimes abbreviated, was developed at Dropbox in 2012, where founder and CEO Drew Houston and successive CFOs Sujay Jaswa and Ajay Vashee recruited a team of finance generalists from investing and investment banking to form one of Silicon Valley’s first Strategic Finance teams. They threw this team at every major scaling challenge a hypergrowth startup could face, and each time, the team responded with analytical rigor, speed and effectiveness.

The Dropbox Strategic Finance team played a crucial part in redefining the Finance function for much of Silicon Valley and created a blueprint for how the Finance organization could transcend its traditional responsibilities and exponentially increase its impact. Dropbox’s Strategic Finance team played an important role in taking the company public, raising hundreds of millions of dollars in debt and equity and building Dropbox into a highly profitable company at scale that now controls its own destiny.

I recently stumbled upon an old picture of the original Dropbox Strategic Finance team and thought it would be a fun picture to share (bad haircuts and all!). All of these folks have gone on to do extraordinary things, including senior finance leadership roles at Decacorn startups like Figma, OpenAI, Plaid and Stripe.

From left to right: Matt Bogrand (YC), Conrad Bastable (Persona), Praveer Melwani (Figma), Pouya Fatemi (Plaid), Stacie Faggioli (Swoop, Stripe), Madhu Jagannathan (Lob), Zeya Yang (A16Z), Luke Flanagan (Fly.io, Twilio), Dan Quinlan (Retool, Expanse), Michael Miao (IVP), Angela Chiang (Motive), Ajay Vashee (IVP), Jon Choi (Teleport), Paul Jun (Pilot), Mariano Esparza (Snowflake), Eve Lim (Rescale), Mark Goldberg (Index), Brad Lightcap (OpenAI)

I joined Dropbox’s Strategic Finance team in 2014, departing in 2016 to become a venture investor at IVP. In both of these roles, I’ve seen firsthand how Strategic Finance massively benefits startups.

I hope this post serves as a helpful resource for CEOs and CFOs that are looking to build a Strategic Finance function or take their Finance team to the next level. I had the pleasure of interviewing several Strategic Finance leaders from Figma (Nicole Wittlin), Grammarly (Kristen Young), Segment (Alex Berkenkamp) and Whoop (Parsa Saljoughian), who graciously shared best practices and strategies for building and scaling a world-class Strategic Finance team.

What does the Finance team do?

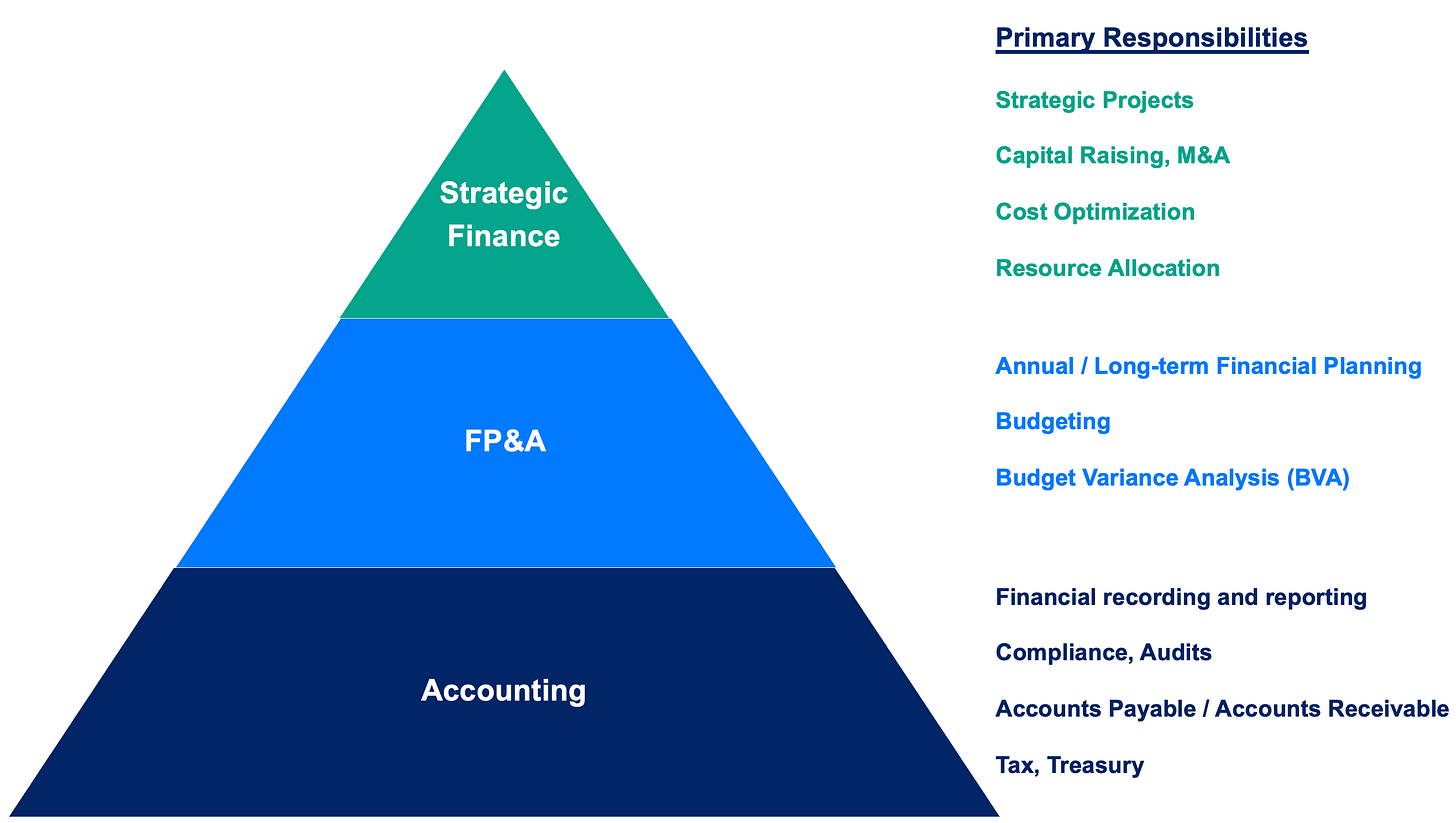

Finance organizations can be broadly segmented – from the ground up – into three layers: Accounting, Financial Planning & Analysis (FP&A) and Strategic Finance (StratFin).

Accounting is the system of record of all financial transactions at a company and is the foundation upon which the entire organization is built. FP&A looks at the past financial performance of the company to predict what the forward trajectory will look like. Strategic Finance helps other teams in the company (product, sales, marketing, engineering, etc.) make better data-driven decisions, raise capital and efficiently allocate resources.

Below is a visual representation of how the three functions relate to one another.

Building Blocks of Finance

Here’s a quick primer on each function you see above:

Accounting

The Accounting team is responsible for producing clean financial statements and making sure that every transaction at the company is accurately reported, which makes Accounting arguably the most important finance function to get right.

Accounting is usually outsourced in the early days of a startup and eventually brought in-house as the Finance function matures. There’s much more to Accounting than simply recording when cash comes in and out of an organization, and there are complicated rules that dictate how to properly recognize revenue and costs.

Financial statements need to be comparable from company to company, which is why there are generally accepted standards for accounting practices that financial auditors hold companies to (i.e., GAAP in the U.S. or IFRS in Europe). As the startup matures, it will eventually bring on a financial controller that makes sure that the accounting team has the right processes, systems and methods in place (usually when there are multiple accountants to manage). A startup does not need audited financial statements in the early days but will eventually need several years of audited financial statements in order to go public.

There are other distinct functions like payroll, accounts payable, accounts receivable, tax and treasury, and these functions typically roll up to the broader Accounting team.

FP&A

The FP&A team creates a financial plan by identifying and making informed assumptions on the key drivers of the business and owns the company model. The FP&A team works cross-functionally with other leaders in an organization and collects input on hiring plans, pricing, new products and other strategic initiatives to give the organization an understanding of how much revenue, expenses and cash burn they should expect in the future.

Most FP&A teams will project one year out, though more sophisticated and mature FP&A teams will build multi-year financial plans. The FP&A team is effectively building a map to guide a startup’s management team.

The more accurate and dialed-in a company’s forecasting ability is, the better the company will be at resource and capital allocation, which is a competitive advantage.

Strategic Finance

Strategic Finance is an emerging, high-impact function that can look and feel different depending on how a given team and company apply it. Strategic Finance is focused on optimizing a company’s underlying business model to create long-term business value by increasing revenue and decreasing costs. It uses data and financial modeling to help the company make better decisions and understand the financial impact. Strategic Finance serves as a cross-functional business partner to all major functions at a company (product, marketing, sales, engineering, etc.).

Strategic Finance Deep Dive

Startups usually start building out their Strategic Finance function post-Series B after there is meaningful top-line traction ($10M+ in revenue).

The Strategic Finance team comprises general-purpose Finance “athletes” that are very strong at financial modeling, data analytics and communicating complex topics to business leaders. The types of projects the Strategic Finance team handles range from pricing, cost optimization, sales compensation, infrastructure, geographical expansion, board meetings and fundraising.

In some startups, the Strategic Finance team will handle FP&A. During my time at Dropbox, for instance, the Strategic Finance team owned all FP&A responsibilities before building a separate FP&A team later on in the company’s journey. But at Whoop, Strategic Finance is a function that is completely separate from FP&A, though the two teams stay very coordinated on all topics. At Grammarly, the FP&A team reports to the Head of Strategic Finance, but Strategic Finance is a separate team that owns all top-line forecasting, while the FP&A team owns all expense forecasting.

Regardless of whether they are separate or not, Strategic Finance and FP&A collaborate closely because the projects that Strategic Finance leads will impact the output of the long-term model.

Strategic Finance will sometimes also include Corporate Development. The Corporate Development team partners closely with product and engineering teams to identify gaps in a company’s product roadmap and uses M&A as a tool to fill them. Corporate Development teams are much more common at late-stage companies where there are enough resources and scale to justify using M&A to accelerate product roadmap, consolidate the market, expand into new markets, acquire revenue or add talent in areas where the company is currently weak.

The Strategic Finance team’s core responsibilities can be summarized as follows:

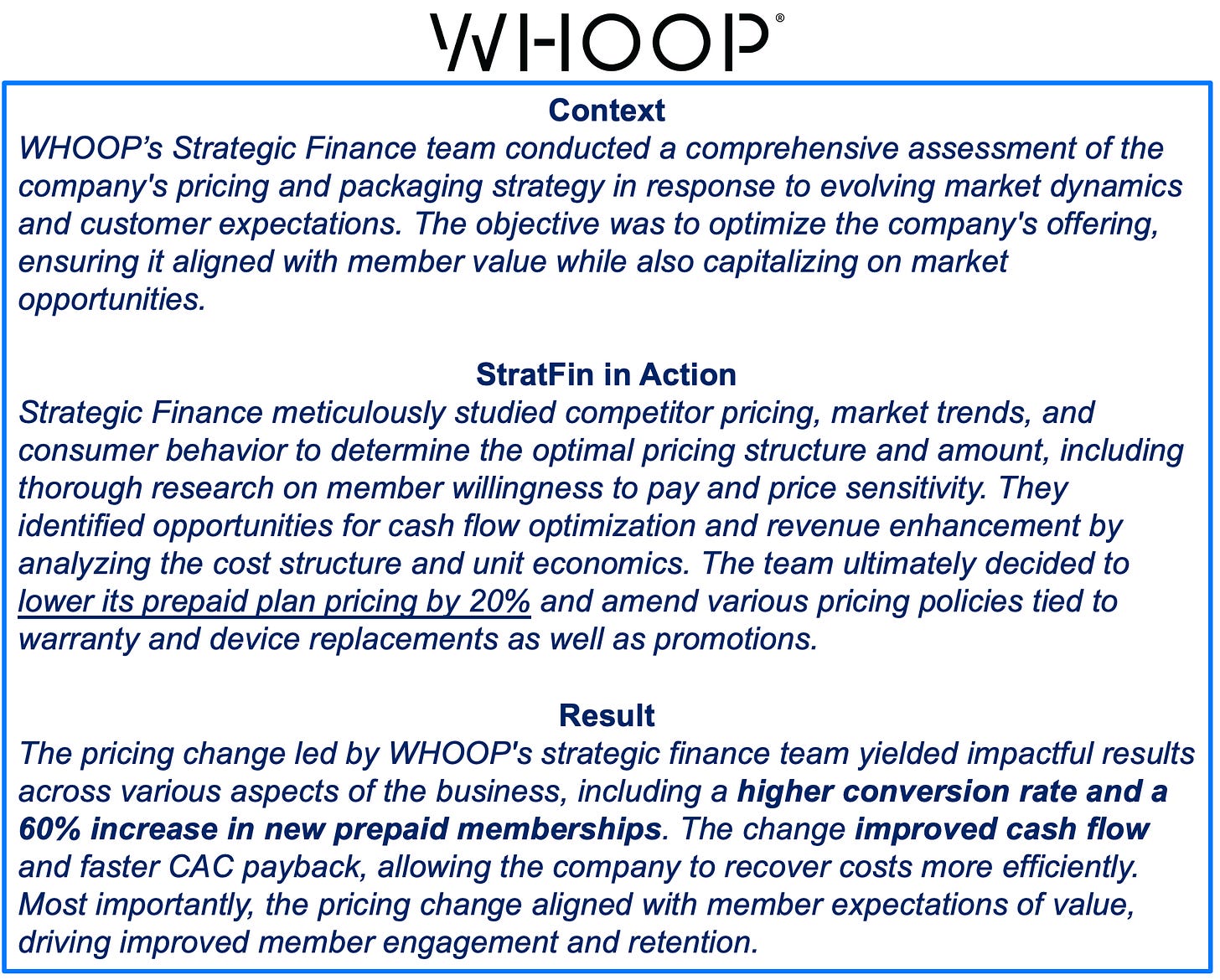

Strategic Finance in Action

The Strategic Finance leaders at Figma, Grammarly, Segment and Whoop told me about the most impactful projects their teams had worked on, which I’ve summarized in the table below. These projects include cost optimization, pricing/packaging, fundraising and improving GTM efficiency and show the broad range of impact Strategic Finance teams can have.

Building a Strategic Finance Team

Never has there been more high-caliber finance talent looking to join the technology industry, thanks to the growing number of junior employees who are placing greater value on impact and purpose. There has been a decade-long exodus of finance talent leaving Wall Street in favor of joining technology startups, which presents a huge opportunity for startups.

Skillsets & Experience

Strategic Finance professionals are spreadsheet wizards, love making sense of complex datasets and are adept at communicating their analyses in terms non-finance colleagues can understand. Given that skillset, most Strategic Finance professionals tend to have an investment banking background, though investing (VC/PE) and management consulting (McKinsey, Bain, BCG, etc.) backgrounds are common as well. But that’s a general statement, not a hard and fast rule. There are plenty of extremely successful professionals in Strategic Finance who came from non-traditional professional backgrounds.

Hiring a Leader

The first step to building a Strategic Finance team is to hire a strong leader. This can be a Head of Finance or VP of Finance with strong strategic and analytical chops. If Finance leadership is already in place (i.e., CFO), companies will hire a Head of Strategic Finance or VP Strategic Finance. This person ideally has at least 6-8 years of work experience and checks every box on the Strategic Finance Checklist:

Strategic Finance leaders are most often recruited through their professional networks, so CEOs and executive team leaders should be sure to ask their company’s investors to identify and introduce potential candidates. Executive recruiting firms can also help but typically use a broader scope to identify recruits (e.g., a CFO or VP Finance that oversees Accounting, FP&A and Strategic Finance).

Hiring Managers and Associates

After a Strategic Finance leader has been hired, that person will need to build a team of mid-level and junior folks under them. For these positions, strong financial modeling skills and data fluency are critical, so these individuals are usually recruited out of investment banking or other Strategic Finance teams. Head-hunting firms that focus on placing entry-level investment banking or consulting candidates into private equity, venture capital, or hedge fund roles, like Glocap or Amity, can be very helpful.

These candidates can also be sourced from your professional network or with the help of your investors. VC Associates will usually have great recommendations so be sure to leverage them.

If you are building a Strategic Finance function from scratch, I recommend you target candidates with 4+ years of experience (investment banking + operating/investing) vs. hiring straight out of investment banking. It’s better to have direct reports that can hit the ground running faster vs. needing to train a candidate straight out of an investment bank.

Team Size

Strategic Finance works best when the team is lean. The optimal size for a Strategic Finance team is typically 5-15 people, depending on the size of the company and the complexity of its business model. At larger and more complex businesses, like Uber, for example, the Strategic Finance team can be significantly larger.

At Dropbox, our early Strategic Finance team was successful and we were allowed to significantly expand, from a lean team of 10 people to almost 20 within a few quarters. The team was still successful, but there was not enough high-impact work to go around, and individual productivity rates slowed and learning opportunities weren’t as abundant.

The lesson being: The ideal size of a Strategic Finance team is nuanced and varies by company, but it’s better to have a smaller team of high-horsepower individuals than letting the team get too large.

Interviewing Candidates

When interviewing candidates, test for cultural fit and strategic thinking.

Cultural Fit

If you are hiring candidates from investment banking, it’s important to make sure that the candidate will thrive in a technology startup environment. Investment banking is a fantastic training ground that breeds financial acumen, modeling skills and a world-class work ethic but is also a different work culture than startups. If you hire straight out of investment banking, pay attention to the candidate’s humility, ego, collaboration skills, and passion for technology – all necessary attributes.

Strategic Thinking

"Strategic Finance," as the name suggests, necessitates the ability to think strategically as a fundamental component of the role. A reliable method to evaluate a candidate's strategic thinking capability is providing them with a case study that presents a problem they would encounter on the job. Usually, these case studies are take-home and give the candidate a few days to a week to complete. The take-home format and uncapped time limit are intentional, so you can assess how much effort a candidate spends on the case study based on the end product, which is a proxy for their work ethic and how excited they are about the job.

The most effective format for a take-home case study is a case study prompt with raw, anonymized company data. An example of a good prompt is as follows:

“With 6 months of paid data available, the team has asked you to provide a brief report that summarizes how the paid product has performed and provide a recommendation for where the monetization team should be focusing their attention over the next 3 months.”

At Dropbox, the prompt that we used was as follows:

“Analyze our Dropbox for Business pricing and make a recommendation. Output: 1 slide to tee up 15-20 minutes of discussion”

I dug up my Dropbox StratFin case study response for fun (link here). It’s almost a decade old, but it gives you a sense of what StratFin hiring managers look for. Good case study responses should be thorough, data-informed and provide well-thought-out suggestions/recommendations

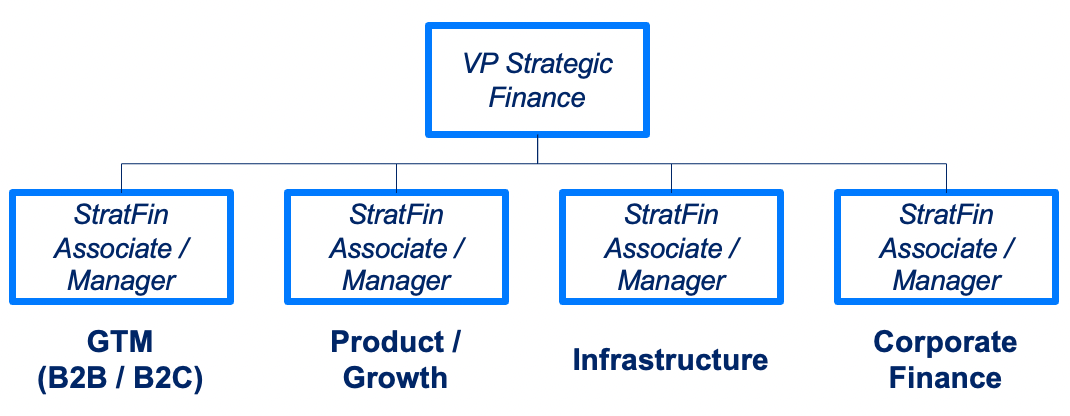

Strategic Finance Org Structure

Strategic Finance teams are led by a Head of Strategic Finance or VP Strategic Finance that reports directly to the CFO. Given how lean Strategic Finance teams are, they tend to be hierarchically flat. Team members usually have a focus area (e.g., GTM, Product, Infrastructure, etc.), and there will usually be a subteam that owns the company model and headcount planning (i.e., corporate finance), assuming Strategic Finance owns FP&A.

For leaner teams newer to Strategic Finance, the org chart might look something like this.

For larger teams that have a more mature Strategic Finance function, the organization would have more hierarchy, represented in the chart below. There will usually be 1-3 StratFin associates reporting to one StratFin manager in larger Finance teams.

Strategic Finance Best Practices

A CEO or CFO building a Strategic Finance function wants to make it a success. In collaboration with Strategic Finance leaders at Figma, Grammarly, Segment and Whoop, I created a list of best practices for CEOs and CFOs to help their teams achieve just that.

Ensure CEO-CFO Accountability and Alignment

Strategic Finance teams function best when there is a culture of accountability that comes from the top down. CEOs and CFOs need to hold their functional leaders to a budget and instill a culture of managing to metrics. Without that culture, empowering Strategic Finance to drive change becomes very difficult.

Encourage a Bias Toward Action

An effective Strategic Finance team requires a high degree of trust between StratFin and senior leadership.

Strategic Finance works best when teams are proactively identifying problems and solving them, instead of reactively responding to requests from the executive or the board. Encourage Strategic Finance leaders to make “ask for forgiveness, not for permission” their default posture toward the executive team. StratFin should not push changes without the consent of their cross-functional business partners but should be proactive in recommending solutions and highlighting their financial impact.

Provide the Broader Context

Strategic Finance teams are great at being able to see the big picture, because the nature of their work is cross-functional. That makes Strategic Finance teams an efficient vehicle to disseminate and contextualize the “why” behind major initiatives to the broader organization. That works only if CEOs and CFOs habitually communicate the broader context behind decisions to Strategic Finance teams.

Create a Culture of Data and Analytics

Strategic Finance thrives in a culture that strongly values data and analytics. That means having a robust data warehouse and sufficient resourcing to make sure that analytics are accurate and easy to access. Financial analysis is “garbage in, garbage out” – without ready access to clean and reliable data, you’re wasting your time.

Invest in Next-Gen Finance Tooling

Strategic Finance teams can remain lean by investing in tools that automate tedious tasks. A typical mistake is spending too much time collecting, cleaning and checking disparate sources and not enough doing high-value strategic work and analysis. Finance teams should invest in tooling that automates laborious manual processes so they can focus on higher leverage projects. Figma, for instance, uses Pigment to automate headcount planning and long term planning.

Conclusion

The technology industry is heading into a challenging period where capital will be increasingly scarce and data-driven decision making will be critical for survival. Strategic Finance has never been more important, and the companies that thrive coming out of this downturn will be the ones with a well-developed Strategic Finance muscle. If you are interested in Strategic Finance or have any questions, please reach out!

Special thanks to Parsa Saljoughian (Whoop), Nicole Wittlin (Figma), Kristen Young (Grammarly), and Alex Berkenkamp (Segment) for sharing their experiences scaling Strategic Finance teams with me.

despite these fancy anecdotes, dropbox flat since 2018 ipo and down vs 2014 private val. seems to me that they needed to not pay finance guys 250k 2 years out of college haha